✅ Disclaimer: This article is for educational purposes only. Health insurance options and benefits vary depending on state regulations, provider networks, and individual eligibility.

Introduction

Retirement brings newfound freedom—but also new financial and healthcare responsibilities. For many older adults, understanding health insurance for retirees is essential to avoid unexpected bills, access critical care, and enjoy peace of mind in your later years.

While Medicare forms the foundation of most retiree coverage in the U.S., it doesn’t cover everything. In 2025, understanding health insurance for retirees means navigating a complex mix of Original Medicare, Medigap, Medicare Advantage, Part D drug plans, and additional supplemental options. This guide offers a clear, detailed breakdown of health insurance for retirees, complete with real-world examples, plan comparisons, and smart decision-making tips.

By the end of this article, you’ll know exactly how to evaluate your choices, avoid costly surprises, and select a plan that supports both your lifestyle and long-term health needs in retirement.

1. Understanding the Basics: What Health Insurance for Retirees Includes

Medicare: The Foundation

Most Americans become eligible for Medicare at age 65. It consists of:

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice.

- Part B (Medical Insurance): Covers doctor visits, outpatient care, preventive services, lab tests.

- Part D (Prescription Drugs): Standalone drug plans offered by private insurers.

- Medicare Advantage (Part C): All-in-one plans from private insurers that combine Parts A and B, often Part D, and may offer extras like dental or vision.

- Medigap (Supplemental Insurance): Covers out-of-pocket costs like deductibles, copays, and coinsurance for those with Original Medicare.

Understanding how Medicare works is essential when evaluating health insurance for retirees, especially as you approach age 65. With multiple components like Part A, Part B, Part D, and optional add-ons such as Medigap or Medicare Advantage, choosing the right combination is critical to ensuring comprehensive coverage during retirement.

Whether you want predictable costs through a Medigap plan or the bundled convenience of a Medicare Advantage policy, the foundation of health insurance for retirees begins with knowing what Medicare includes—and what it doesn’t. Make sure to assess your health needs, prescription requirements, and provider preferences before selecting your path forward.

📌 Note: You cannot enroll in both Medigap and Medicare Advantage at the same time. You must choose one route.

2. Comparison Table: Medicare vs. Medicare Advantage vs. Medigap

| Feature | Original Medicare + Medigap | Medicare Advantage (Part C) |

|---|---|---|

| Doctor Access | Any provider accepting Medicare | Often limited to a network |

| Referrals | Not required | Often required |

| Out-of-Pocket Max | No cap (without Medigap) | Annual limit (e.g., $7,550) |

| Premiums | Higher (Medigap + Part B + D) | Often lower (Part C) |

| Drug Coverage | Requires Part D | Often included |

| Extras (Dental, Vision) | Usually not covered | Frequently included |

✅ Use this chart as your starting point when choosing health insurance for retirees based on flexibility and cost predictability.

This comparison table highlights the key differences between Original Medicare paired with Medigap and Medicare Advantage (Part C), helping you evaluate which path makes the most sense for your retirement needs.

When selecting health insurance for retirees, one of the biggest decisions is whether to prioritize flexibility (with Medigap) or convenience and simplicity (with Medicare Advantage). For example, Original Medicare with Medigap offers access to any doctor nationwide who accepts Medicare—ideal for retirees who travel often or want more control. However, it often comes with higher monthly premiums and requires separate enrollment for drug coverage (Part D).

On the other hand, Medicare Advantage plans usually come with lower premiums, built-in drug coverage, and additional benefits like dental and vision—but access is limited to specific provider networks, and referrals are often required for specialists.

If you’re looking for health insurance for retirees that balances cost with convenience, this chart can serve as your roadmap to choosing the plan structure that fits your medical habits, budget, and lifestyle goals.

Name: James (67) from Illinois

Status: Recently retired, moderate prescription needs, sees three specialists

Initial Concern: Worried about high out-of-pocket drug costs and access to out-of-network specialists.

James’s Journey:

- Researched Medicare Advantage: Found plans with $0 premiums but limited specialist networks.

- Spoke with a broker: Recommended Medigap Plan G + Part D drug plan.

- Compared costs:

- Medigap G monthly premium: $168

- Part D premium: $32

- Part B premium: $174.70 (2025 standard rate)

- Total monthly: ~$375

- No referrals needed, could keep current specialists.

➡️ Outcome: Although James pays more per month, he feels secure knowing he has full nationwide access and very few surprise costs.

4. Most Trusted Providers for Health Insurance for Retirees in 2025

| Provider | Type | Highlights |

| UnitedHealthcare | Medicare Advantage, Medigap, Part D | SilverSneakers fitness, large networks |

| Humana | Medicare Advantage | Strong on dental/vision/hearing coverage |

| Aetna CVS | Medicare Advantage | Affordable premiums, CVS pharmacy integration |

| Mutual of Omaha | Medigap | Competitive rates on Plan G & N |

| Cigna | Part D, Medigap | Great formulary for chronic medications |

🎯 Always check provider networks and star ratings at Medicare.gov before enrolling.

The table above highlights some of the most trusted providers of health insurance for retirees in 2025. Whether you’re looking for comprehensive Medicare Advantage plans, prescription drug coverage (Part D), or supplemental Medigap options, these companies consistently receive high ratings from retired policyholders.

- UnitedHealthcare offers a strong mix of Medicare Advantage, Part D, and Medigap plans, including access to large provider networks and fitness benefits like SilverSneakers.

- Humana is a go-to choice for retirees prioritizing dental, vision, and hearing coverage under Medicare Advantage.

- Aetna CVS stands out for its affordability and convenient pharmacy integration—ideal for those who regularly fill prescriptions.

- Mutual of Omaha provides competitive Medigap options, especially for Plan G and Plan N, which are popular among retirees seeking fewer out-of-pocket expenses.

- Cigna offers robust Part D plans with excellent formularies for chronic medications, making it suitable for retirees managing ongoing health conditions.

Choosing the right health insurance for retirees means balancing cost, provider access, and service quality. These providers offer a wide range of options to support the diverse needs of U.S. retirees entering their Medicare years.

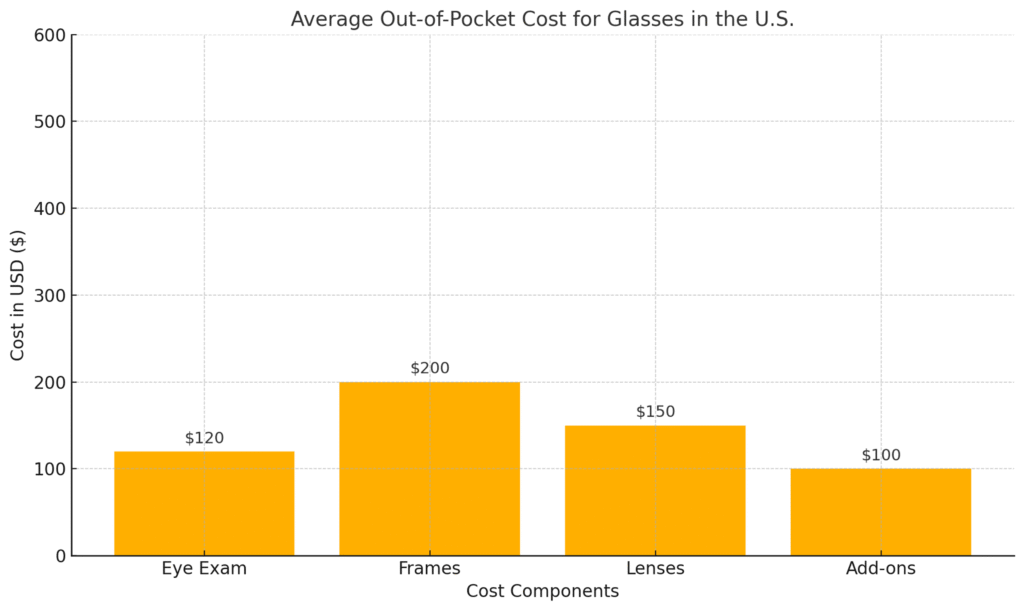

5. Chart Placeholder: Average Monthly Premiums by Plan Type

This chart will visualize typical monthly premium ranges in 2025:

- Medicare Advantage: $0–$70

- Medigap Plan G (age 65): $150–$210

- Part D Plans: $15–$50

📊 Chart Insight: Comparing Health Insurance Costs for Retirees

This bar chart compares estimated costs for retirees under three different plan types in 2025:

- Medicare Advantage offers low premiums but may result in higher yearly out-of-pocket expenses.

- Medigap + Part D has higher upfront premiums but typically lowers overall annual spending.

- Original Medicare Only seems cost-effective at first but exposes retirees to high risk of unexpected bills.

👉 The takeaway: When choosing health insurance for retirees, don’t focus only on monthly costs—look at the total annual expense.

6. Critical Features to Consider Before Choosing a Plan

- Provider Access: Do your doctors accept the plan?

- Prescription Coverage: Are your medications covered at a reasonable cost?

- Out-of-Pocket Limits: Some plans offer annual protection; others don’t.

- Dental/Vision/Hearing: Medicare doesn’t cover these—check if your plan does.

- Travel Needs: Original Medicare + Medigap often covers emergencies nationwide or abroad.

Common Pitfall:

Failing to enroll in Part D on time can result in lifetime penalties—even if you don’t currently take medication.

7. Real-Life Decision Checklist

Before choosing your health insurance for retirees, ask:

- What’s my monthly budget for health insurance?

- Do I travel frequently?

- Do I want to choose my own specialists?

- What are my medication needs?

- Do I prefer low premiums or predictable costs?

8. Frequently Asked Questions (FAQ)

Q1: What is the best health insurance for retirees who travel frequently?

A: Original Medicare + Medigap is best for retirees who want flexibility and nationwide access. Some Medigap plans even offer limited international coverage.

Q2: Can I switch from Medicare Advantage to Medigap?

A: Yes, but only during certain times (like the Medicare Advantage Disenrollment Period). You may also be subject to medical underwriting.

Q3: Does Medicare cover dental and vision?

A: No. You’ll need a Medicare Advantage plan with those benefits, or a standalone supplemental plan.

Q4: Is Medicare Part B mandatory?

A: No, but delaying enrollment can cause penalties unless you have other credible coverage.

Q5: What’s the most comprehensive Medigap plan?

A: Plan G is the most popular for new enrollees. It covers all costs except the Part B deductible.

Final Thoughts

Choosing health insurance for retirees isn’t just about picking the cheapest plan. It’s about balancing cost, access, and peace of mind—especially as healthcare needs become more complex with age.

If you’re healthy and budget-conscious, Medicare Advantage may work well with its lower monthly premiums and bundled benefits. But if you want greater flexibility, fewer network restrictions, and more predictable expenses, Original Medicare plus Medigap could be a better fit. These choices become even more important as retirees often face fixed incomes and rising healthcare demands.

Understanding health insurance for retirees early can help you avoid costly surprises later. The right plan not only protects your finances—it ensures that you receive timely, high-quality care when you need it most. Whether you’re retiring next year or already enrolled in Medicare, take the time to compare plans, explore subsidy options, and consider future needs like prescriptions, dental, and long-term care.

Don’t wait until you’re sick to evaluate your coverage. Use trusted tools like Medicare.gov, or speak with a licensed Medicare advisor to make informed decisions about your retirement healthcare. By preparing now, you can retire with greater confidence, knowing your health is in good hands.

Need help picking the right health insurance for retirees? Use trusted tools or talk to an expert today.

About Us

At Health & Save, we believe understanding U.S. health insurance shouldn’t be complicated.

Our mission is to make insurance information simple, smart, and transparent.

Our resources are crafted to guide you through key decisions in choosing the right health insurance plan.

- Understand health insurance basics

- Explore Medicaid, CHIP, and private plan options

- Learn from real-world claim case studies

- Make informed decisions for your family and future

🧠 Our content is designed to be plain, practical, and easy to apply—no jargon, just clarity.

🔗 Want to read more? Visit our Content Page to request additional resources or ask questions.

📅 Last Updated: 2025-05-26

📢 This site earns revenue through Google AdSense.

![🏥 [Louisiana] How Louisiana’s Obesity Rate Affects Your Health Insurance Premiums image](https://healthnsave.com/wp-content/uploads/2025/05/image-37-150x150.png)