✅ Disclaimer: This article is for educational purposes only. Coverage details vary by insurance provider, state regulations, and the nature of your dental procedure.

Introduction

“Does health insurance cover dental procedures?” It’s a common and important question. Most people assume the answer is a flat “no”—but that’s not always true. While routine dental care usually requires separate dental insurance, there are critical exceptions where health insurance covers dental procedures—especially when they’re medically necessary.

In this guide, we’ll break down the exceptions, real-life examples, how to get coverage, and what to ask before your next dental visit. If you’ve ever wondered whether health insurance could help pay for an expensive tooth surgery or jaw-related treatment, this article is for you.

1. Why Health Insurance Usually Doesn’t Cover Dental Procedures

In the U.S., health insurance is designed primarily to cover medically necessary procedures—including surgeries, diagnostic testing, emergency treatment, and long-term disease management. Dental care, however, is typically classified under a separate umbrella because it’s considered preventive or maintenance-based, involving services such as routine cleanings, fillings, crowns, and implants.

Because of this separation, health insurance covers dental procedures only under very specific circumstances. The majority of dental treatments are deemed elective or cosmetic, which excludes them from general health coverage. This is precisely why most people carry separate dental insurance policies or pay out-of-pocket for routine oral care.

Unless your dental condition is tied to a larger medical issue—such as an infection spreading to other parts of the body, or trauma requiring hospitalization—health insurance will typically not provide coverage. Understanding this boundary is the first step in knowing when and how health insurance covers dental procedures, and what to do if your situation falls into a gray area.

2. Exceptions: When Health Insurance Covers Dental Work

Although most routine dental care is excluded, there are well-defined exceptions where health insurance covers dental procedures due to their medical nature. These include:

- Trauma or injury-related procedures (e.g., car accidents resulting in fractured teeth or jaws)

- Oral surgery for removal of tumors, cysts, or abscesses

- Tooth extractions necessary before undergoing radiation or chemotherapy

- Emergency interventions for severe dental infections that impact breathing or eating

- Hospital-based general anesthesia for patients with special needs, children, or complex dental surgeries

- Jaw reconstruction surgeries tied to congenital defects or chronic diseases

In these medically justified cases, health insurance does not treat the dental work as a cosmetic or elective expense—it sees it as part of a larger health issue. As a result, health insurance covers dental procedures in full or in part, depending on your plan and the documentation your healthcare provider submits.

The key is medical necessity: if your dental issue threatens your general health or requires intervention beyond a dental office, your health insurance may step in. Being aware of these exceptions can help you advocate for coverage, especially when the dental procedure is essential to your physical well-being.

3. Real Cases Where Health Insurance Covered Dental Surgery

To fully understand when health insurance covers dental procedures, let’s look at actual U.S. case examples where claims were approved due to medical necessity:

- Jaw Fracture from a Bike Accident: A 42-year-old male in Texas suffered a severe jaw fracture after a cycling accident. The surgery required wiring the jaw, extracting several damaged molars, and post-operative hospitalization. His health insurance covered the hospital stay, anesthesia, imaging, and surgical costs due to the trauma-related nature of the procedure.

- Oral Tumor Removal: A 55-year-old woman in California experienced facial swelling and pain due to a benign oral tumor pressing on her back teeth. After a biopsy and partial extraction, the surgeon submitted documentation citing medical urgency. Her health insurance covered diagnostics, surgery, and post-op care.

- Tooth Removal Before Cancer Treatment: A 64-year-old cancer patient in Illinois was advised to extract two infected molars before starting chemotherapy. The oncologist provided a letter of medical necessity, and the ACA-compliant plan fully covered the dental surgery, noting its role in preventing systemic infection during treatment.

- Severe Dental Infection Causing Facial Swelling: A 29-year-old man in Florida checked into the ER with extreme facial swelling and fever. A CT scan revealed a dental abscess spreading toward his sinus cavity. He underwent emergency drainage and extraction under general anesthesia. Since the infection posed a life-threatening risk, the procedure was covered by his health insurance.

These real-life cases demonstrate that health insurance covers dental procedures when the situation involves trauma, systemic health risk, or preparation for other critical treatment. The key to approval? Documentation from both dental and medical professionals showing the procedure’s necessity.

4. What Dental Procedures Are Commonly Denied by Insurance

Just as there are exceptions, there are also clear exclusions. Most insurance plans will deny dental treatments that are considered routine or cosmetic in nature. Below are some of the most frequently denied services:

- Routine cleanings, x-rays, and fluoride treatments

- Cosmetic dentistry, such as veneers, bonding, and teeth whitening

- Orthodontic treatments like braces or Invisalign, unless tied to jaw alignment issues caused by trauma

- Dental implants, unless medically necessary due to accident or disease

- Wisdom tooth extractions not tied to infection, cysts, or impaction

In all of these cases, health insurance covers dental procedures only if the provider proves a direct link to your overall physical health. If the dental work is merely to enhance appearance or prevent potential issues, it typically falls outside of coverage. That’s why separate dental insurance or out-of-pocket payment is often necessary.

Understanding both sides—the approved and the denied—can help you better prepare, document, and appeal if needed.

5. How to File a Dental Insurance Exception Claim

If your dentist or doctor believes your dental procedure has a medical basis, you may be able to get it covered under your health insurance policy. However, it won’t happen automatically. You’ll need to take specific steps to prove that the dental work qualifies as medically necessary. Here’s how to improve the odds that your health insurance covers dental procedures like surgery or extractions:

- Obtain a Detailed Diagnosis Letter: Ask your dentist, oral surgeon, or physician to write a letter explaining why the dental procedure is medically necessary. This letter should clearly state the impact on your general health or how the issue is related to a current illness, injury, or condition.

- Use the Correct Billing Codes: Health insurance claims require CPT (Current Procedural Terminology) or ICD-10 (International Classification of Diseases) medical codes. Dental codes (CDT) are often denied outright. Confirm that your provider submits the claim using medical—not dental—coding.

- Submit a Pre-Authorization Request: Before undergoing treatment, ask your provider to submit a pre-authorization form to your health insurance. This document outlines the planned procedure, why it’s necessary, and what medical risk is involved if it’s not performed. This step alone can often determine whether the health insurance covers dental procedures.

- Explain the Hospital Context: If the procedure requires sedation, general anesthesia, or must be performed in a hospital due to a medical condition or special needs, make sure this is documented. Health insurance is more likely to cover dental work when it cannot be safely done in a regular dental office.

- Prepare for an Appeal: Even if your initial claim is denied, you have the right to file an appeal. Use all medical records, photos, scans, and letters from your doctors to build a compelling case. The appeals process is where many patients successfully prove that health insurance covers dental procedures due to medical necessity.

6. What to Ask Your Doctor or Insurer Before a Dental Procedure

Before you go through with any major dental treatment that might fall in a gray area between health and dental care, ask your providers these smart questions. Being proactive can save you money—and improve the chance that your health insurance covers dental procedures you didn’t think were eligible:

- “Is this considered medically necessary or purely cosmetic?” → Understanding this helps you know whether it’s worth pursuing coverage under health insurance or if it will fall entirely under dental.

- “Have you successfully submitted similar procedures to health insurance?” → A provider who has done this before knows how to phrase documentation and use correct codes to ensure approval.

- “Can I get a written medical explanation or a letter of necessity?” → A strong written record is crucial when filing a claim, especially if your insurer requests proof.

- “Will this procedure be billed using CPT medical codes or CDT dental codes?” → Always try to have your treatment billed with CPT codes whenever possible—it’s the only way many health insurers will process your claim.

By asking these questions upfront, you’ll be more prepared and better protected. Many patients are surprised to learn that health insurance covers dental procedures when proper documentation is in place and the situation qualifies as a medical necessity.

7. Best Insurance Plans That Might Cover Dental Exceptions

Not all plans treat dental-related medical issues the same. Look for these features:

| Plan Type | Notes |

|---|---|

| ACA Marketplace Bronze/Silver | Often cover medically necessary dental surgery when linked to illness or trauma |

| Employer PPO Plans | May allow overlapping dental-medical claims in complex cases |

| Medicaid (in some states) | Covers dental for adults only when medically essential |

| Children’s CHIP Plans | Often more generous with dental-medical overlap |

When comparing, don’t just ask if dental is included. Ask if medical-dental exceptions are addressed in your plan’s benefits booklet.

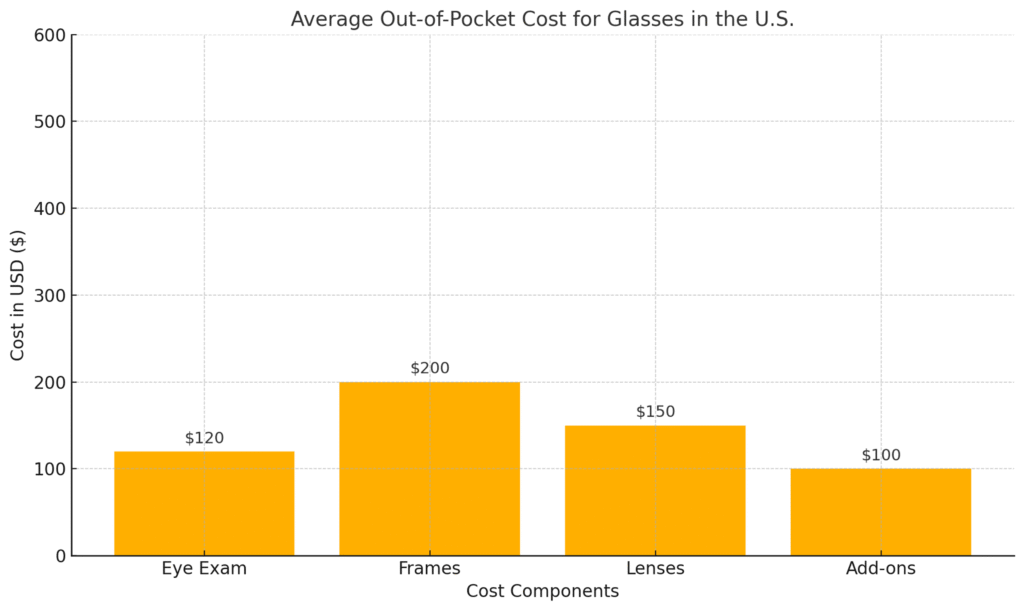

📊 Chart: Top 5 Dental Procedures Commonly Covered by Health Insurance

This chart shows which dental-related procedures are most frequently approved under health insurance in the U.S. as of 2025.

✅ This visual makes it clear why knowing when health insurance covers dental procedures is so valuable.

This chart shows which dental-related procedures are most frequently approved under health insurance in the U.S. as of 2025. While not all plans cover every case, these procedures have relatively high approval rates due to their medical necessity.

✅ This illustrates why understanding when health insurance covers dental procedures can save patients thousands in out-of-pocket costs.

Quick Summary Table

| Scenario | Covered by Health Insurance? | Notes |

| Wisdom tooth removal for braces | ❌ | Considered elective |

| Tooth extraction before chemo | ✅ | If medically required |

| Jaw surgery after accident | ✅ | Hospitalization involved |

| Emergency swelling & ER visit | ✅ | If airway is compromised |

| Dental implants for cosmetic use | ❌ | Cosmetic exclusion applies |

💡 As this table shows, health insurance covers dental procedures only when they are medically necessary or tied to serious health risks—such as infections, trauma, or cancer preparation. If the procedure is cosmetic or elective, health insurance typically won’t apply.

Frequently Asked Questions (FAQ)

Q1: Is it worth trying to get health insurance to cover dental surgery?

Yes—if your dental procedure is the result of trauma, disease, or medically diagnosed complications, it’s absolutely worth pursuing. Many patients assume they must pay out of pocket, but in reality, health insurance covers dental procedures more often than people realize when the treatment is essential to their overall health. To qualify, documentation must clearly show the medical necessity.

Q2: Can health insurance cover dental implants?

Yes, but only under specific circumstances. If the implants are required due to injury, congenital defect, or a condition that affects eating, speaking, or health, then health insurance covers dental procedures such as implants in a medical context. However, purely cosmetic implants, such as replacing a single tooth for aesthetic reasons, are typically not eligible.

Q3: What if my dentist only uses dental codes?

Health insurers rely on medical billing codes to process claims. If your dentist uses CDT (dental) codes only, ask them to partner with a physician or oral surgeon who can submit the procedure using CPT or ICD-10 codes. This significantly increases the chance that health insurance covers dental procedures like extractions or surgery.

Q4: Is anesthesia for dental procedures ever covered?

Yes. When general anesthesia is medically necessary—especially for complex oral surgery, children, or patients with disabilities—health insurance covers dental procedures involving hospital-based sedation. The key is proving that the procedure cannot be done safely in a traditional dental office.

Q5: Can I appeal a denied dental-medical claim?

Absolutely. Every patient has the right to appeal. If your procedure was denied but meets criteria for medical necessity, compile all supporting documents (x-rays, diagnosis, treatment plan, letters from doctors). Many successful cases prove that health insurance covers dental procedures once proper context is established and communicated in the appeal.

Being informed and persistent is essential. Understanding the medical standards and advocating with your provider helps ensure that health insurance covers dental procedures when your health truly depends on it.

Final Thoughts

The idea that health insurance never touches dental care is a myth. With the right circumstances and medical justification, health insurance covers dental procedures more often than people realize.

Whether you’re facing a complex surgery or a necessary extraction related to a health condition, don’t assume it’s all out-of-pocket. Get documentation, ask questions, and use this guide to increase your chances of coverage.

About Us

At Health & Save, we make U.S. health insurance simple, practical, and family-friendly. Our guides help everyday people get the most from their coverage—especially in confusing or overlooked situations.

👉 Visit Health & Save

🗓️ First Published: 2025-06-01

🔄 Last Updated: 2025-06-01

🟡 This site earns revenue through Google AdSense to support free content.