✅ Disclaimer: This article is for educational purposes only. Insurance options, prices, and eligibility vary based on your state, provider, income, and health status.

Introduction

Losing health coverage even temporarily can feel terrifying.

Whether it’s a job change, recent graduation, divorce, or waiting for open enrollment, many Americans suddenly find themselves without health insurance for a few months. In 2025, one of the most practical solutions for short gaps is short-term health insurance for 3 months.

But what exactly does this type of insurance cover? Is it legal in your state? And most importantly does it really protect you if something goes wrong during that window?

This guide explains everything you need to know about short-term health insurance for 3 months, including pros, cons, eligibility, coverage tips, and real-life examples that could save you thousands.

1. What Is Short-Term Health Insurance for 3 Months?

Short-term health insurance for 3 months is a temporary safety net for people caught between life events and permanent insurance solutions. Unlike long-term health plans that are ACA-compliant and often require specific enrollment windows, short-term policies are available year-round and are ideal when life doesn’t follow a neat calendar.

Let’s break down exactly what this plan means:

- “Short-Term” refers to a policy duration typically ranging from 30 days to 364 days, depending on state regulations. The 3-month version is one of the most popular, especially in states that limit duration or prohibit longer terms.

- “Health Insurance” here covers urgent or unexpected medical needs—not full-spectrum health maintenance like ACA plans.

These plans are best thought of as “catastrophic fallback options”—something to keep you financially afloat in case you’re hospitalized, injured, or hit with sudden medical bills.

✅ Common Features of 3-Month Plans:

| Feature | Description |

|---|---|

| No open enrollment required | Buy any time—great for emergencies or recent changes |

| Fast processing | Approval usually within 24–48 hours |

| Lower premiums | You might pay 60–80% less than ACA plans |

| Limited benefits | Covers emergency care, not preventive services |

Who Is This For?

You might be the perfect candidate for short-term health insurance for 3 months if:

- You recently left a job and don’t want to pay high COBRA premiums

- You just graduated and are no longer covered by your school or parent’s plan

- You’re waiting for your new job’s health benefits to kick in (often there’s a 30–90 day gap)

- You missed Open Enrollment and don’t qualify for a Special Enrollment Period (SEP)

- You’re in a transition zone—between relationships, locations, or insurance statuses

📌 Real-life trigger example:

Anna just moved to a new state and her ACA Marketplace options won’t activate until she’s officially a resident. Rather than go uninsured for 60+ days, she chooses a 3-month short-term plan to cover potential emergencies.

2. What Does It Typically Cover (and Not Cover)?

Short-term health insurance for 3 months is not a comprehensive solution—but it can protect you against massive medical bills. Let’s be honest: even one ER visit can cost thousands. These plans are designed to help you avoid financial devastation during coverage gaps—not to manage long-term health conditions.

✅ Usually Covered

| Service Type | Covered? | Details |

|---|---|---|

| Emergency Room | ✅ | Often 70–80% coverage after deductible |

| Surgery / Hospitalization | ✅ | Covered under inpatient benefits |

| Doctor Visits | ✅ | Usually for acute illness or injury (e.g., strep throat) |

| Lab Tests / Imaging | ✅ | Covered when medically necessary |

| Prescription Discounts | ⚠️ Partial | Most offer discount cards, not full Rx coverage |

⛑ Example: You twist your ankle while running and need an X-ray. Your short-term plan may cover urgent care, X-ray imaging, and crutches—after deductible.

❌ Usually Not Covered

| Service Type | Excluded? | Why? |

|---|---|---|

| Pre-Existing Conditions | ❌ | Nearly all plans exclude them—check policy details |

| Mental Health | ❌ | Therapy, counseling, and psych meds are rarely included |

| Preventive Care | ❌ | No physicals, mammograms, or vaccines |

| Maternity | ❌ | Pregnancy, delivery, and postnatal care excluded |

| Vision / Dental | ❌ | Must buy separate stand-alone plans for these |

⚠️ Real risk:

You had mild asthma as a teenager. You haven’t used an inhaler in 5 years, but during your short-term plan, a sudden attack puts you in the ER. The insurer may argue it was pre-existing and deny your claim.

3. When Should You Consider 3-Month Short-Term Plans?

Short-term health insurance for 3 months is most useful during “in-between” times—when life changes fast and long-term options aren’t available yet. Many Americans face brief gaps in coverage each year, especially if they:

- Change jobs

- Move across state lines

- Lose dependent status

- Age out of their parent’s plan

- Divorce or separate

- Start freelancing or gig work

Here are some real-life use cases and why a 3-month plan works:

🧾 Scenario Table

| Life Event | Why a 3-Month Plan Helps |

|---|---|

| 🧑💼 New Job, Benefits Start in 90 Days | Protects you during the waiting period for employer coverage |

| 🎓 College Graduation | Buys time before you find a job or enroll in ACA plan |

| 💔 Divorce or Breakup | If you were on your spouse’s plan, coverage may end abruptly |

| 🛫 Moving States | Your ACA coverage won’t transfer—state residency required first |

| ❌ Missed Open Enrollment | If you don’t qualify for SEP, you’ll go uninsured without short-term options |

💡 Bonus Tip

Check COBRA vs Short-Term Tradeoffs

If you left a job, COBRA gives you the exact same coverage as your previous employer—but at full cost (sometimes $500–$1,200/month). A short-term health insurance plan for 3 months may cost under $100/month, although with fewer protections.

4. Cost Comparison of Short-Term Health Insurance vs. ACA Plans

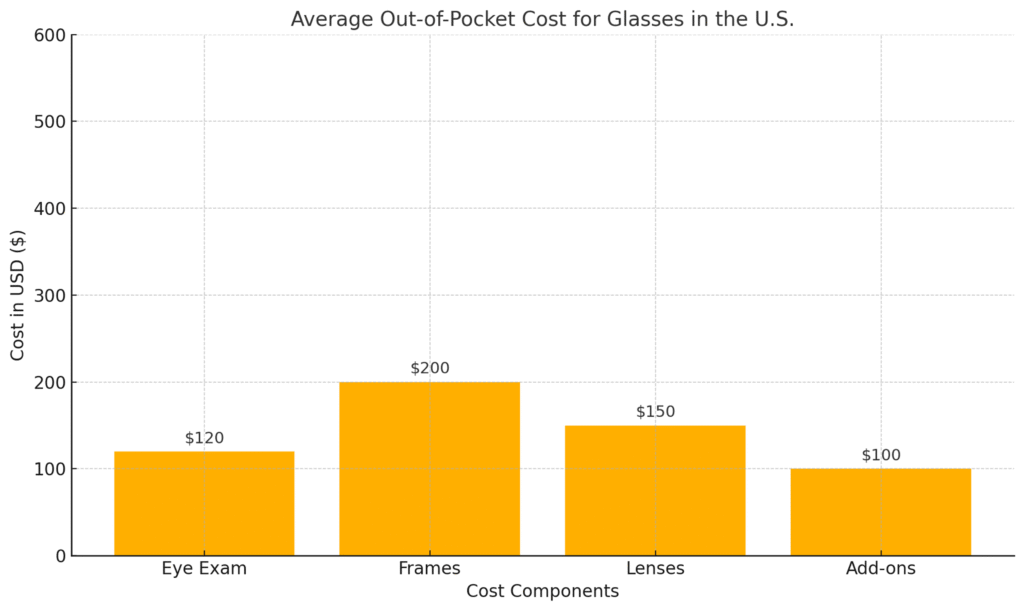

This chart provides a visual comparison between short-term health insurance and ACA-compliant major medical plans. It specifically highlights two critical cost factors: monthly premium and deductible, using 2025 average estimates.

- The short-term health insurance plan shows a lower monthly premium ($90) but a significantly higher deductible ($5,000), making it ideal for emergency protection only.

- The ACA plan costs more per month ($420) but has a much lower deductible ($1,500), which supports preventive care and broader coverage.

This illustration helps you quickly understand whether short-term health insurance aligns with your financial and medical risk tolerance for a limited 3-month period.

(Include: Monthly premium, deductible, network access, coverage scope, renewability)

5. Key Pros and Cons of Short-Term Health Insurance

Short-term health insurance can be a valuable bridge during uncertain times—but it’s not for everyone. Understanding its strengths and limitations is critical before signing up.

✅ Pros of Short-Term Health Insurance

| ✅ Pros | Detailed Description |

|---|---|

| Low Monthly Premiums | Compared to ACA plans, short-term health insurance is often 60–80% cheaper. It’s one of the most budget-friendly options for temporary coverage. |

| Quick Approval | Many applicants get approved within 24–48 hours, which is vital if you’re between jobs or recently lost coverage. |

| Flexible Enrollment | No need to wait for Open Enrollment—you can apply any time of the year. |

| Cancel Anytime | Unlike ACA plans that are locked in, you can cancel short-term coverage without penalty if your situation changes. |

| Good Fit for Healthy People | If you don’t have ongoing health needs, this insurance can be a smart, affordable fallback plan. |

❌ Cons of Short-Term Health Insurance

| ✅ Pros | Detailed Description |

|---|---|

| No Coverage for Pre-Existing Conditions | This is one of the biggest downsides. If you have diabetes, asthma, anxiety, or other diagnosed conditions, they may be fully excluded—even if inactive. |

| Limited Benefits | There’s no coverage for preventive care, maternity, mental health, or long-term prescription needs. |

| Not Renewable in Many States | Some states cap short-term policies at 3 months and do not allow extensions. |

| Maximum Coverage Caps | Some plans may only pay up to $250,000 or $1M, after which you’re on your own. |

| State-by-State Legality | In some states (like California), short-term health insurance is banned altogether. |

📌 Pro Tip: Always ask for a copy of the full benefits summary and read the “exclusions and limitations” section. Don’t assume you’ll be covered like with a regular ACA plan.

✅ 6. Which States Allow 3-Month Short-Term Plans in 2025?

One of the most confusing parts of short-term health insurance in the U.S. is that state rules vary dramatically. In some places, these plans are fully legal and renewable. In others, they’re banned or tightly restricted.

🗺️ 2025 State Policy Map

| State Type | States | Description |

|---|---|---|

| ❌ Banned | California, New York, New Jersey, Massachusetts | These states prohibit short-term health insurance entirely due to concerns over limited benefits and consumer risk. |

| ⚠️ Strictly Limited | Colorado, Connecticut, Maryland, Washington | May allow short-term plans but only for a short duration (e.g., 90–180 days) and only once per year. |

| ✅ Permissive / Flexible | Texas, Florida, Arizona, Georgia, North Carolina, Indiana | Often allow up to 364-day plans with renewal options; popular among self-employed or gig workers. |

7. Real-Life Case: How Short-Term Health Insurance Helped (and Didn’t)

Case #1: It Worked

Jake, 29, was laid off from a startup and had no coverage between jobs. He enrolled in a 3-month short-term health insurance plan for $85/month. Just two weeks into his new plan, Jake experienced severe abdominal pain and was diagnosed with appendicitis.

He underwent emergency surgery and spent two nights in the hospital. The total cost of treatment, including ER services, surgery, anesthesia, and hospital stay, came to $13,000. Because his condition was new and not pre-existing, his short-term health insurance plan covered 80% of the bill after he met his $2,000 deductible.

💰 Final cost: Jake paid $2,000 (deductible) + $2,200 (20% of remaining $11,000) = $4,200 out of pocket, and insurance covered the remaining $8,800. Without the plan, he would’ve been fully responsible for the full $13,000.

Case #2: It Didn’t Work

Sarah, 42, missed the ACA enrollment window and purchased a short-term health insurance plan thinking it would serve as a safety net. She had a long-standing history of migraines but hadn’t had an episode in months.

Three weeks after starting coverage, she suffered a serious migraine that required hospitalization. However, her claim was denied because her condition was classified as “pre-existing” based on her prescription history and previous doctor visits.

🚫 Final cost: Sarah was responsible for the full $7,800 hospital bill, since short-term health insurance does not cover pre-existing conditions unless explicitly stated.

💡 Lesson:

Short-term health insurance works best for healthy individuals facing brief gaps in coverage. It’s critical to read the fine print, especially regarding exclusions, payout limits, and pre-existing conditions. What works for one person may not work for another.

8. How to Choose the Right 3-Month Short-Term Health Plan

Choosing the right short-term health insurance plan involves more than just comparing monthly premiums. Here’s what to look for:

🔍 Key Questions to Ask:

- What’s the total deductible? Higher deductibles mean lower premiums, but also more out-of-pocket risk.

- Are pre-existing conditions excluded? Most short-term plans do not cover them—make sure you understand what counts as “pre-existing.”

- Is there a maximum payout limit? Some plans cap coverage at $250,000 or even less.

- Can I cancel without penalty? Some plans allow cancellation at any time with a prorated refund.

- How long is the application and approval process? Many plans approve applicants within 24 hours.

- Does it cover telehealth or urgent care? These benefits are useful for minor issues without visiting a hospital.

🧭 Where to Compare Plans:

Use comparison platforms to shop and apply directly:

Proactively comparing features and reading the exclusions section of each plan ensures you avoid costly surprises. Short-term health insurance is a financial tool—use it wisely to protect against temporary gaps in coverage. How to Choose the Right 3-Month Short-Term Health Plan

When comparing plans, ask the following:

- What’s the total deductible?

- Are pre-existing conditions excluded?

- Is there a maximum payout limit?

- Can I cancel without penalty?

- How long is the application and approval process?

- Does it cover telehealth or urgent care?

🔎 Use platforms like Pivot Health, eHealth, or HealthSherpa to compare providers.

10. Frequently Asked Questions (FAQ)

Q1. Can I extend my short-term health insurance after 3 months?

A: Sometimes, but it depends on your state and provider. Some insurers allow extensions or re-enrollment for up to 12 months total. However, states like California, New York, and New Jersey do not permit extensions at all. Before purchasing, check whether your state has duration limits or renewal restrictions.

Q2. Is short-term insurance ACA-compliant?

A: No. Short-term health insurance plans are not compliant with the Affordable Care Act (ACA). This means:

- No guaranteed coverage for pre-existing conditions

- No essential health benefits (e.g., maternity, mental health, preventive care)

- No income-based subsidies

That’s why premiums are lower—but so is the level of protection.

Q3. Will it cover COVID-19 treatment in 2025?

A: In most cases, yes. Since the pandemic began, many short-term health plans have added COVID-related coverage. But this varies widely. Some plans may cover testing and outpatient treatment, while others might not cover hospitalization. Always review the plan’s benefits and exclusions section before enrolling.

Q4. Can I cancel it early if I get a full-time job?

A: Yes. One of the advantages of short-term health insurance is flexibility. Most plans allow you to cancel at any time without a penalty. Once you secure employer-sponsored insurance or enroll in a qualified ACA plan, you can terminate the short-term coverage with prorated refunds (if applicable). Be sure to notify the insurer in writing.

Q5. What happens if I get sick during the 3-month period?

A: As long as the illness is not related to a pre-existing condition and falls within the plan’s covered services, you can receive treatment and benefits. However, these plans usually have high deductibles and may only reimburse a percentage of costs (e.g., 60% to 80%). Always know your deductible, coinsurance rate, and maximum coverage amount before you seek care.

📌 Tip: Emergency room visits, outpatient surgery, and doctor visits for new illnesses are usually covered. But services like mental health, physical therapy, or preventive screenings are not.

It’s not a perfect fit for everyone—but for many facing temporary gaps, a short-term health insurance plan can be a life-save If you’re healthy and need fast, affordable coverage during a life change, these plans can be a smart safety net.

Just be sure to:

- Understand exclusions and limits

- Check state laws

- Use comparison tools

When used correctly, short-term health insurance for 3 months can protect your finances and give you peace of mind while you transition to better coverage.

Final Thoughts

Short-term health insurance for 3 months can be a valuable safety net when you’re in between jobs, waiting for open enrollment, or facing a temporary gap in coverage. While it doesn’t offer the same depth of protection as ACA-compliant plans, it provides quick, flexible, and affordable access to medical care in emergencies or short-term health situations.

That said, these plans are not one-size-fits-all. They are best suited for:

- Healthy individuals with no chronic or pre-existing conditions

- People who understand the exclusions and are willing to accept some financial risk

- Those transitioning between major life events (job changes, relocation, divorce, graduation)

Before enrolling, be sure to:

- Compare multiple short-term health insurance plans side-by-side

- Read the full policy documents—including exclusions, waiting periods, and benefit caps

- Understand the total cost (not just monthly premiums, but deductibles and coinsurance)

- Check your state’s regulations about short-term coverage

🛡️ Used strategically, short-term health insurance for 3 months can help you avoid catastrophic medical bills during life’s uncertain moments. But it’s critical to go in with open eyes and full understanding of what it does—and doesn’t—cover.

If you’re unsure where to start, platforms like Pivot Health, eHealth, and HealthSherpa can help you compare your options quickly.

And remember: when your situation stabilizes, transitioning to a full ACA-compliant plan should always be the long-term goal for comprehensive protection.

About Us

At Health & Save, our mission is to help everyday Americans make sense of the complex U.S. health insurance system. Whether you’re exploring ACA plans, short-term coverage, or special enrollment options, we provide clear, actionable information to guide your decisions with confidence.

🔗 Learn more at healthnsave.com

🟡 To keep our resources free, this site earns revenue through Google AdSense.