Disclaimer: This article is for educational purposes only. Premium changes vary based on state regulations, employer plans, and insurance carriers.

Introduction

Health insurance for self-employed individuals in the U.S. can be confusing, expensive, and time-consuming to compare. Being your own boss has perks—flexibility, independence, and control over your time—but health insurance isn’t usually one of them.

In this guide, we’ll walk through the most affordable and accessible health coverage options for freelancers, consultants, gig workers, and small business owners in the U.S. for 2025. Whether you’re just getting started or looking to save more this year, this breakdown will help you confidently choose the best self-employed health insurance plan for your situation.

1. What Health Insurance Options Are Available for the Self-Employed?

Finding the right health insurance for self-employed individuals in the U.S. can feel overwhelming at first but the good news is that there are multiple types of plans available to fit different needs and budgets.

Here are the major options:

| Option | Details |

|---|---|

| Healthcare.gov Marketplace | Offers ACA-compliant plans with premium tax credits based on income. Most common entry point for the self-employed. |

| State Marketplaces | Some states like California (Covered California) or New York offer additional state-level subsidies on top of federal ones. |

| Private Health Insurance | Direct from insurers or brokers; provides more plan variety, but usually no subsidies. |

| COBRA | Lets you temporarily extend your previous employer’s coverage—useful during transitions, but often expensive. |

Many self-employed individuals start by comparing plans on Healthcare.gov. The platform allows you to input your projected income and receive a subsidy estimate before enrolling.

🔎 Key Insight: If your income fluctuates month to month, still make your best estimate. Health insurance for self-employed individuals adjusts annually, and you can update your income if needed.

2. Most Affordable Plans and Providers in 2025

There’s no one-size-fits-all when it comes to health insurance for self-employed individuals, but several providers have earned strong reputations for affordability, accessibility, and member satisfaction.

| Provider | Plan Type | Best For |

|---|---|---|

| Oscar Health | Marketplace PPO | Tech-savvy freelancers and gig workers who want easy digital access |

| Kaiser Permanente | HMO | Low-cost premiums and excellent preventive care for those in covered states |

| Blue Cross Blue Shield | PPO/HMO | Wide network access nationwide |

| Molina Healthcare | HMO | Affordable premiums with strong subsidy compatibility |

| Cigna | EPO/PPO | Great for those who value wellness programs and virtual care |

🧠 Pro Tip: If you’re under 30 or qualify for a financial hardship exemption, consider a Catastrophic Plan. These are ultra-low premium plans designed for worst-case emergencies—but they include free preventive care.

No matter which provider you choose, always compare plans by ZIP code, as availability and pricing vary drastically by region. This is crucial if you’re self-employed and move frequently or work remotely.

3. Can You Deduct Health Insurance Premiums as a Self-Employed Individual?

Yes—you can deduct 100% of your health insurance premiums from your taxable income if you’re self-employed. This is one of the biggest tax advantages of working for yourself.

✅ Eligibility Criteria:

- You must have net self-employment income from a sole proprietorship, LLC, or freelance gig.

- You cannot be eligible for a group plan through an employer or a spouse.

- The policy must be in your name or a dependent’s name.

🔍 Deductible Expenses Include:

- Your personal monthly premiums

- Coverage for your spouse

- Dependents, including children under age 27

- Medicare premiums if you’re over 65 and still self-employed

📌 These deductions reduce your adjusted gross income (AGI), which means you pay less in federal income tax overall.

💡 For many freelancers, these tax savings can make managing health insurance much more affordable in the long run.

4. How to Lower Your Costs as a Freelancer or Business Owner

- Use Healthcare.gov or state exchanges to compare subsidies and plan details

- Choose a High Deductible Health Plan (HDHP) and pair it with an HSA for tax savings

- Join associations or freelance unions that offer group rates (e.g., Freelancers Union)

- Take advantage of free preventive care under ACA-compliant plans

- Use telehealth services to reduce visit costs

Remember, U.S. health insurance for self-employed individuals doesn’t have to be out of reach—it just takes smart planning and regular comparison shopping.

5. Common Mistakes to Avoid When Buying Health Insurance as a Freelancer

Choosing a self-employed health insurance plan isn’t just about price—it’s about avoiding long-term financial surprises. Many freelancers unknowingly lock themselves into plans that don’t match their real healthcare needs. Here are some common errors to avoid:

- Only looking at monthly premiums: A low premium may mean a high deductible or limited coverage. Make sure to also compare out-of-pocket maximums and copays.

- Not checking provider networks: Some plans restrict access to specific doctors or hospitals. Before you enroll, confirm your preferred providers are in-network.

- Missing out on HSA-eligible plans: If you’re relatively healthy, pairing a High Deductible Health Plan (HDHP) with a Health Savings Account (HSA) can result in major tax benefits—an often-overlooked win in managing health insurance for self-employed individuals.

- Failing to update income estimates: If your estimated income is off, you might end up owing money during tax season or miss out on subsidies.

✅ Quick Tip: Always compare three plans side-by-side and simulate at least one “bad health year” to see total costs including deductibles and coinsurance.

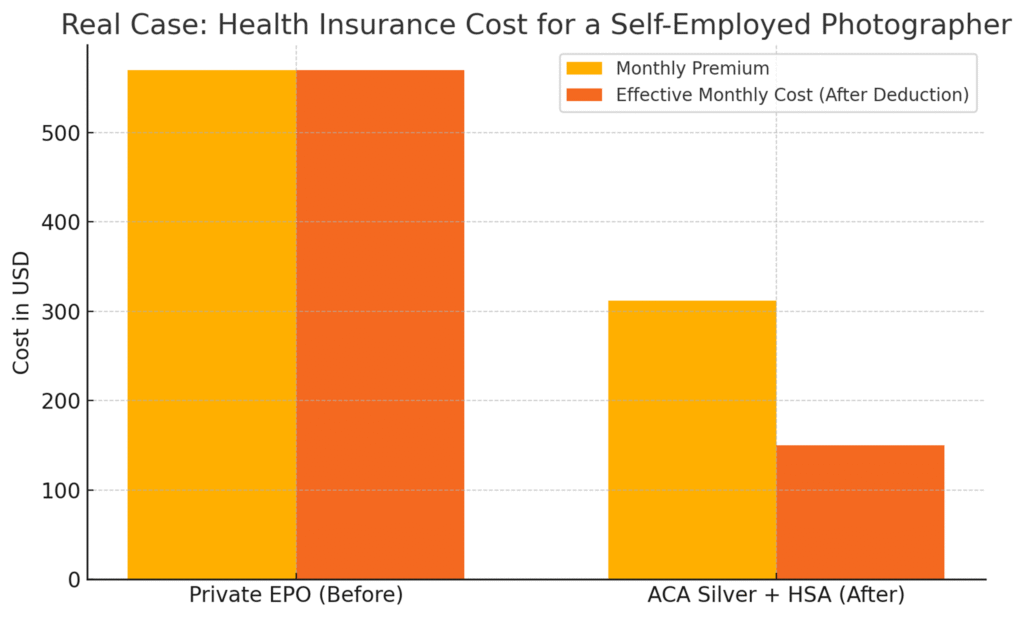

6. Real Case: How a Photographer Saved $2,400 on Health Insurance

📍 Location: Austin, Texas

👤 Profile: 34-year-old full-time photographer

💼 Income: ~$42,000/year (net profit)

Before

Tried a Private EPO plan with a premium of $570/month. Though it offered freedom to choose doctors, it had no subsidy and did not qualify for HSA. Annual cost: $6,840.

After

Switched to a Silver ACA plan via Healthcare.gov, with a subsidized premium of $312/month. Because the plan was HSA-compatible, the photographer contributed $2,000 to an HSA—fully deductible. Tax-adjusted monthly cost dropped to $150.

Annual effective cost: $3,600.

📉 Savings: Over $3,000 when factoring in tax benefits + premium reduction.

📊 Chart: Cost Comparison

7. What If You Have a Pre-Existing Condition?

One of the top concerns for those seeking health insurance for self-employed individuals is managing care with a pre-existing condition like diabetes, asthma, or depression.

Thanks to the Affordable Care Act (ACA), insurers:

- Cannot deny coverage

- Cannot charge higher premiums due to pre-existing conditions

- Must cover essential benefits like mental health, prescriptions, and maternity care

However, some tips are important:

- Stick to ACA-compliant plans (via Healthcare.gov or state marketplaces). Avoid short-term or “non-ACA” plans that legally don’t have to cover pre-existing conditions.

- Review the drug formulary list: Some plans may technically cover your condition but offer limited medication options, so compare formularies carefully.

- Use state programs if eligible: Medicaid expansion in your state may provide full coverage at low cost if income is below a certain level.

👉 Key Insight: Even with a chronic illness, ACA protections ensure that self-employed individuals still have access to affordable health insurance and with smart selection, affordable too.

Quick Summary

| Option | Best For |

| Healthcare.gov + subsidies | Most self-employed individuals |

| Kaiser Permanente | Budget-conscious HMO users |

| Catastrophic Plans | Under 30 or hardship exemptions |

| HDHP + HSA | Long-term savers + tax deduction seekers |

| Premium Deductions | All qualified self-employed tax filers |

U.S. health insurance for self-employed individuals can be tailored to your income, tax strategy, and healthcare needs. Use your 2025 coverage window wisely.

❓ Frequently Asked Questions (FAQ)

Q1. What is the best health insurance for self-employed individuals if I have a limited income?

A:

If you’re self-employed and earning a modest income, the most affordable health insurance for self-employed individuals is usually found through Healthcare.gov. You may qualify for premium tax credits or cost-sharing reductions based on your income level. These savings can significantly lower both your monthly premiums and out-of-pocket costs.

Many freelancers earning under $50,000 per year qualify for subsidized Silver-tier plans, which offer a strong balance of coverage and affordability. Always input your projected annual income during enrollment to see the most accurate subsidy estimates.

Q2. Can I buy health insurance for self-employed individuals at any time during the year?

A:

No, unless you qualify for a Special Enrollment Period (SEP). In general, health insurance for self-employed individuals must be purchased during the Open Enrollment Period, which typically runs from November 1 to January 15 each year.

However, if you’ve lost other coverage (e.g., left a job, divorced, aged out of your parents’ plan), you may be eligible for SEP. It’s important to act quickly—Special Enrollment windows usually last 60 days from the triggering event.

A:

Yes, and this is a major benefit of being your own boss. If you have net self-employment income, you’re allowed to deduct 100% of your health insurance premiums on your federal tax return. This includes:

- Your personal plan

- Your spouse’s coverage

- Dependents under 27

This deduction reduces your adjusted gross income (AGI), meaning you pay less in overall federal income tax. Just ensure your health insurance for self-employed individuals is not part of a spouse’s employer plan and that you’re reporting positive net income.

A:

Missing a payment for your health insurance for self-employed individuals could lead to a grace period—and eventually a loss of coverage. Most ACA-compliant plans offer a 90-day grace period if you receive a subsidy. But after that, your plan may be canceled retroactively.

To avoid this, consider setting up auto-pay or budgeting your premium into your monthly expenses. Losing your coverage mid-year could leave you uninsured until the next Open Enrollment, unless you qualify for a SEP.

Q5. Is short-term health insurance a good option for self-employed individuals?

A:

Short-term plans may look cheap, but they’re risky. Unlike ACA plans, short-term health insurance for self-employed individuals:

- Doesn’t cover pre-existing conditions

- May deny coverage based on health history

- Often omits essential services like maternity care or prescriptions

These are best used for gap coverage only—like between jobs or waiting for Open Enrollment. They’re not ideal if you want full protection for chronic conditions or major medical events.

Q6. Can I use an HSA with my health insurance for self-employed individuals?

A:

Yes—if you choose a High Deductible Health Plan (HDHP) that qualifies under IRS rules. This setup allows self-employed individuals to open a Health Savings Account (HSA), which provides:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses

This is one of the most powerful tools to manage health insurance for self-employed individuals, especially for those who want to save long-term or reduce taxable income while staying covered.

Final Thoughts

Navigating U.S. health insurance for self-employed individuals in 2025 doesn’t have to be a nightmare. With tax advantages, ACA subsidies, and a growing number of digital-first health plans, you can find a solid option that works for your wallet and your well-being.

Be sure to update your plan annually, explore professional group discounts, and maximize your health-related tax deductions. In the long run, the right policy could save you thousands.

About Us

At HJ Easy Insurance, we help U.S. freelancers and small business owners simplify their insurance choices.

🏥 Health & Save

🚗 Car & Save

✈️ Trip & Save

❤️ Life & Save

🗓️ First Published: 2025-05-10

🔄 Last Updated: 2025-05-10

This site earns revenue through Google AdSense.

Sources

- Healthcare.gov – 2025 Marketplace Subsidy Guide

- IRS – Self-Employed Health Insurance Deduction

- Freelancers Union – Health Insurance Resources

- Policygenius – Affordable Plan Comparisons

![🏥 [Louisiana] How Louisiana’s Obesity Rate Affects Your Health Insurance Premiums image](https://healthnsave.com/wp-content/uploads/2025/05/image-37-150x150.png)

![🏥 [For Children] State-by-State Guide to CHIP and Medicaid for Children in the U.S. image](https://healthnsave.com/wp-content/uploads/2025/05/image-19-150x150.png)